看新闻·燃气

LNG市场:供应过剩将持续到2020年,但未来会供应不足

液化天然气(LNG)在全球能源市场发挥着越来越重要的作用。它便宜、充足和相对环保。但是,和其他商品一样,是受到周期性的影响。长期以来,液化天然气因与原油价格挂钩,此前油价高起之时在全球范围启动了大量新建项目。预计这些项目的出产将在未来几年内陆续涌入市场,由此带来的供应过剩情况将持续至2020年;此后,因未来需求持续增长而产出下降,LNG市场将逐渐恢复平衡。

事实上,全球LNG市场此前曾经历了一段强劲的增长。数据显示,自1990年以来,全球每年对LNG的需求总量都以6.2%的平均速率增长,比石油需求增长的4倍还多。世界各地都将LNG视为廉价而清洁的能源,特别是在发电领域,广受欢迎。大多数的LNG贸易都是签订长期合同,价格同油价挂钩;如今,LNG也越来越多地出现在现货市场上。2012年,现货市场上或是通过短期合同(低于4年)销售的LNG在总量中的占比为25%;2014年,这一比例上升至29%。从国家和地区看,卡塔尔仍是全球LNG市场最大的出口国,2015年LNG出口量占到全球总量的31.4%。

2020年前,全球LNG供应能力将以每年8%的速度快速增长。2014年之前,由于需求大增、油价高企,全球许多国家上马了大量新的LNG项目。自2014年年中以来,原油价格的暴跌,有些还处于早期设计阶段的项目很有可能被叫停,但是,这其中仍有一小部分预计近期将陆续投产,特别是那些已经开工建设并即将完工的项目,由此导致近期仍将有大量LNG供应涌入市场,特别是来自澳大利亚、美国和俄罗斯的供应。

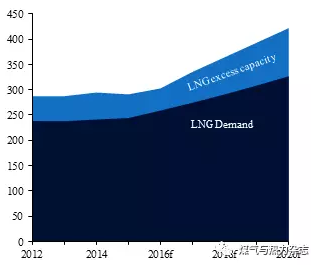

全球液化天然气需求和供应

(每年数百万吨)

来源:波士顿咨询集团,高盛(Goldman Sachs)、国际能源署和QNB经济预测

然而供应前景在很大程度上通过现有项目的进展来预测;且对价格波动不太敏感,上图显示的需求是不大确定的。但即使全球在2020年前,对LNG需求的年增速能保持在6%,仍然慢于市场供给能力的增长。只有两种情况下,全球LNG需求会出现强劲增长。一是短期内天然气大量代替煤炭成为主要发电原料,以满足环境目标。这种情况预计在中国和欧洲出现的可能性更大。另一种就是在飞速增长的新兴市场,比如印度,电力需求的快速增长将带动LNG需求大幅攀升。

从供需前景得出三个预计。一、未来5年内,全球LNG市场都将处于供过于求的局面。二、长期供应过剩的市场对现货价格产生压力,使得越来越多的买家放弃长期合同,转入现货市场购买,进而又推动了长期合同的修改。三、枯竭的项目管道(目前为止在2016年没有新的工厂批准),LNG项目的长生产周期(5年或更久),和高预期的需求增长,并伴随着更多环保措施被实施,在2020年后将会出现供不应求。换言之,液化天然气市场的强周期性会继续持续10年。

来源:卡塔尔国家银行经济刊

附原文:

Liquefied natural gas (LNG) is playing an increasingly important role in the global energy market. It is cheap, abundant and relatively clean environmentally. But, like other commodities, it is subject to cyclical forces. High oil prices in the past, to which LNG contracts are linked, have encouraged the start-up of various projects around the world. Supply from these projects is expected to come into the market over the next few years. As a result, the market is expected to be over-supplied up to 2020. Beyond that, the market is likely to be under-supplied as the current low oil price environment makes starting new projects unviable meaning that demand will eventually catch up.

The global market for LNG has experienced strong growth. Since 1990, demand for LNG has grown at the rate of 6.2% per year, more than four times as fast as demand for oil. LNG stands out as a cheap and clean source of energy, particularly for power generation. Most LNG is sold under long-term contracts, which are linked to oil prices, but it is also increasingly sold on spot markets.The share of LNG sold on the spot or under short-term contracts (less than four years) rose from 25% in 2012 to 29% in 2014. Within the LNG market, Qatar is a dominant player. It is the largest exporter of LNG in the world, accounting for 31.4% of total exports in 2015.

LNG supply capacity is expected to grow strongly by around 8% a year through 2020. The environment of high demand growth and high oil prices prior to 2014 led to a large number of LNG projects being considered globally in a number of countries. But the sharp reversal in oil prices since mid-2014 led to a re-evaluation of these projects. Only a fraction of the considered projects is now expected to come on stream. In particular, those projects already under construction will probably be completed. But those in the earlier design or engineering stage could very well be scrapped. Still, as a result of the projects already under construction, a large amount of LNG supply is expected to hit the market, especially from Australia, the US and Russia.

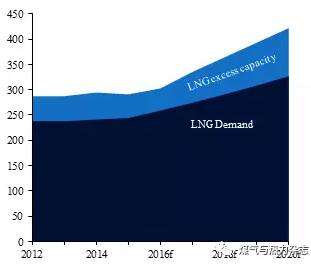

Global LNG demand and capacity

(Millions of tons per annum)

Sources: Boston Consulting Group, Goldman Sachs, International Energy Agency and QNB Economics forecasts

While the supply outlook is largely pre-determined by the progress on existing projects and is relatively insensitive to price movements, the picture for demand is less certain. But even under the bullish scenario of demand growth of 6% a year through 2020, it will still fall short of supply capacity. Such strong demand growth could materialise under two conditions. First, natural gas replacing coal as feedstock for power generation in order to meet global environmental targets. This effect is expected to be particularly visible in China and Europe. Second, higher incomes, particularly in fast-growing emerging markets such as India, leading to increased demand for power and, consequently, for LNG.

Putting together the demand and supply outlooks yields three implications. One, because demand growth is expected to fall short of supply, the LNG market is expected to be over-supplied in the next five years. Two, the over-supplied market is likely to exert downward pressure on spot prices. This could provide incentives for LNG buyers to purchase on the spot market rather than through long-term contracts. This in turn could lead to renegotiations of long-term contracts, which would impact suppliers, especially the new comers. Three, the drying up of the project pipeline (no new plants approved so far in 2016), the long lead time of LNG projects (five years or more) and the strong expected growth in demand as more environmental-friendly measures are implemented should lead to supply shortages beyond 2020. In other words, the strong cyclicality in the LNG market should continue over the next decade.

QNB Economics

津公网安备 12010102000045号

津公网安备 12010102000045号